Full solution

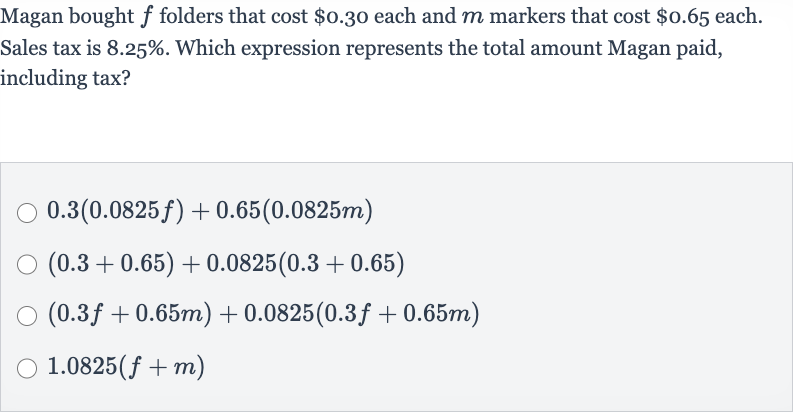

Q. Magan bought folders that cost each and markers that cost each. Sales tax is . Which expression represents the total amount Magan paid, including tax?

- Calculate cost of folders: Calculate the cost of folders without tax.Cost of folders = number of folders * cost per folderCost of folders =

- Calculate cost of markers: Calculate the cost of markers without tax.Cost of markers = number of markers cost per markerCost of markers =

- Calculate total cost before tax: Calculate the total cost before tax.Total cost before tax = Cost of folders + Cost of markersTotal cost before tax = +

- Calculate sales tax: Calculate the sales tax on the total cost.Sales tax = Total cost before tax * sales tax rateSales tax =

- Calculate total cost with tax: Calculate the total cost including tax.Total cost including tax = Total cost before tax + Sales taxTotal cost including tax = + + \(f * \$0.30 + \) * .

- Simplify total cost expression: Simplify the expression for the total cost including tax.Total cost including tax =

More problems from Ratio and Quadratic equation

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help