AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

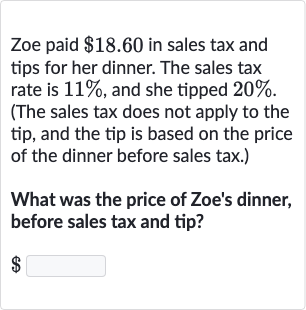

Zoe paid in sales tax and tips for her dinner. The sales tax rate is , and she tipped . (The sales tax does not apply to the tip, and the tip is based on the price of the dinner before sales tax.) What was the price of Zoe's dinner, before sales tax and tip? ◻

Full solution

Q. Zoe paid in sales tax and tips for her dinner. The sales tax rate is , and she tipped . (The sales tax does not apply to the tip, and the tip is based on the price of the dinner before sales tax.) What was the price of Zoe's dinner, before sales tax and tip? ◻

- Define Variables: Let's denote the price of Zoe's dinner before sales tax and tip as . We know that Zoe paid in total for sales tax and tips. We also know that the sales tax rate is and the tip rate is . We can express the total amount paid for sales tax and tips as a sum of of (sales tax) and of (tip).

- Write Equation: We can write the equation based on the information given: (sales tax) + (tip) =

- Combine Percentages: Combine the percentages to simplify the equation:

- Solve for P: Now, we solve for by dividing both sides of the equation by :

- Find Price of Dinner: Perform the division to find the price of Zoe's dinner before sales tax and tip:

More problems from Multi-step problems with percents

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help