AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

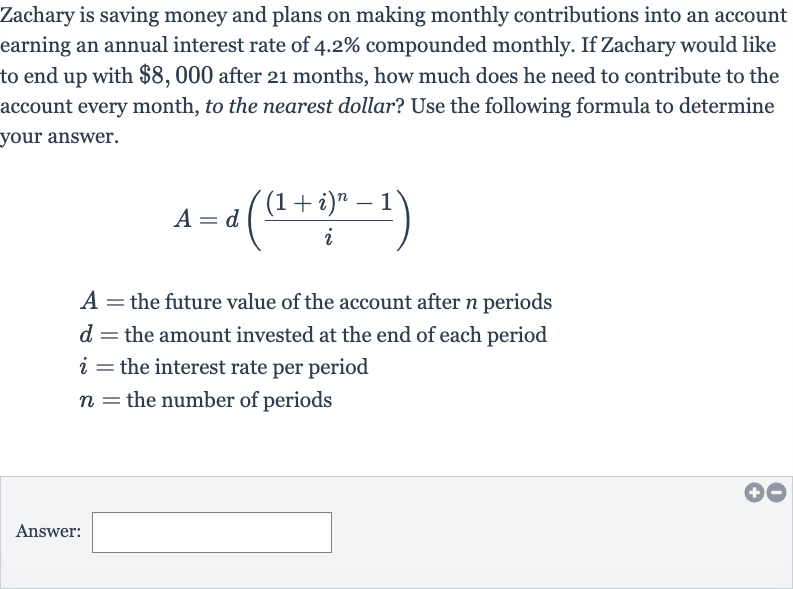

Zachary is saving money and plans on making monthly contributions into an account earning an annual interest rate of compounded monthly. If Zachary would like to end up with after months, how much does he need to contribute to the account every month, to the nearest dollar? Use the following formula to determine your answer. the future value of the account after periods the amount invested at the end of each period the interest rate per period the number of periodsAnswer:

Full solution

Q. Zachary is saving money and plans on making monthly contributions into an account earning an annual interest rate of compounded monthly. If Zachary would like to end up with after months, how much does he need to contribute to the account every month, to the nearest dollar? Use the following formula to determine your answer. the future value of the account after periods the amount invested at the end of each period the interest rate per period the number of periodsAnswer:

- Identify Given Values: Identify the given values from the problem.A (future value of the account) = n (number of periods) = monthsi (interest rate per period) = annual interest rate compounded monthlyFirst, we need to convert the annual interest rate to a monthly interest rate by dividing by (since there are months in a year).i = i = i =

- Convert Annual Rate: Substitute the values into the formula.We have the formula .Now we substitute the values we have into the formula.We need to find .

- Substitute Values: Solve for using the formula.Now we calculate the right side of the equation step by step.First, calculate :

- Solve for : Calculate the compound factor.Now we subtract from the compound factor.

- Calculate Compound Factor: Divide by the interest rate per period.Now we have the denominator of the formula.

- Divide by Interest Rate: Solve for the monthly contribution .

Now we divide both sides by to solve for . - Solve for Monthly Contribution: Round the monthly contribution to the nearest dollar.Zachary needs to contribute approximately every month.

More problems from Compound interest

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help