Full solution

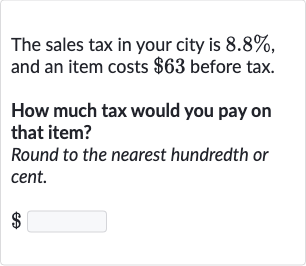

Q. The sales tax in your city is , and an item costs before tax. How much tax would you pay on that item? Round to the nearest hundredth or cent.

- Convert to decimal: Convert the tax rate to decimal by dividing by .

- Calculate tax amount: Multiply the cost of the item by the tax rate to find the tax amount. Tax =

- Perform multiplication: Perform the multiplication to calculate the tax. Tax =

- Round to nearest hundredth: Round the tax to the nearest hundredth.Tax =

More problems from Convert between percents, fractions, and decimals: word problems

QuestionGet tutor help

QuestionGet tutor help