Full solution

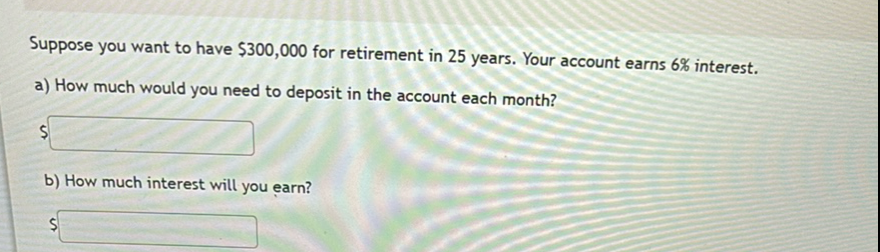

Q. Suppose you want to have for retirement in years. Your account earns interest.a) How much would you need to deposit in the account each month?b) How much interest will you earn?

- Calculate Monthly Deposit: We need to use the formula for the future value of an annuity to find out the monthly deposit required. The formula is:where:FV = future value of the annuity (the amount you want to have saved by retirement)P = monthly payment (what we're solving for)r = monthly interest rate (annual rate divided by )n = total number of payments (months in years)First, we need to calculate the monthly interest rate and the total number of payments.

- Calculate Monthly Interest Rate: The annual interest rate is %, so the monthly interest rate is:

- Calculate Total Payments: There are years and months in a year, so the total number of payments is:

- Solve for Monthly Payment: Now we can rearrange the formula to solve for P, the monthly payment:Substitute the known values into the formula:

- Calculate Denominator: Calculate the denominator of the fraction:This requires a calculator or a spreadsheet to compute accurately.

- Calculate Monthly Payment: Using a calculator, we find:Now we can calculate the monthly payment:

- Calculate Total Amount Paid: Using a calculator, we find:So, you would need to deposit approximately $\(125\).\(23\) each month.

- Calculate Interest Earned: To find out how much interest you will earn, we need to calculate the total amount paid over the \(25\) years and subtract the final amount you want to have.\(\newline\)Total amount paid = monthly payment * number of payments\(\newline\)\[ Total\ amount\ paid = 125.23 \times 300 \]

- Calculate Interest Earned: To find out how much interest you will earn, we need to calculate the total amount paid over the \(25\) years and subtract the final amount you want to have.\(\newline\)Total amount paid = monthly payment * number of payments\(\newline\)\[ Total\ amount\ paid = 125.23 \times 300 \]Using a calculator, we find:\(\newline\)\[ Total\ amount\ paid = 125.23 \times 300 \approx 37569 \]

- Calculate Interest Earned: To find out how much interest you will earn, we need to calculate the total amount paid over the \(25\) years and subtract the final amount you want to have.\(\newline\)Total amount paid = monthly payment * number of payments\(\newline\)\[ Total\ amount\ paid = 125.23 \times 300 \]Using a calculator, we find:\(\newline\)\[ Total\ amount\ paid = 125.23 \times 300 \approx 37569 \]Now, calculate the interest earned by subtracting the final amount from the total amount paid:\(\newline\)\[ Interest\ earned = Total\ amount\ paid - Final\ amount \]\(\newline\)\[ Interest\ earned = 37569 - 300000 \]