Full solution

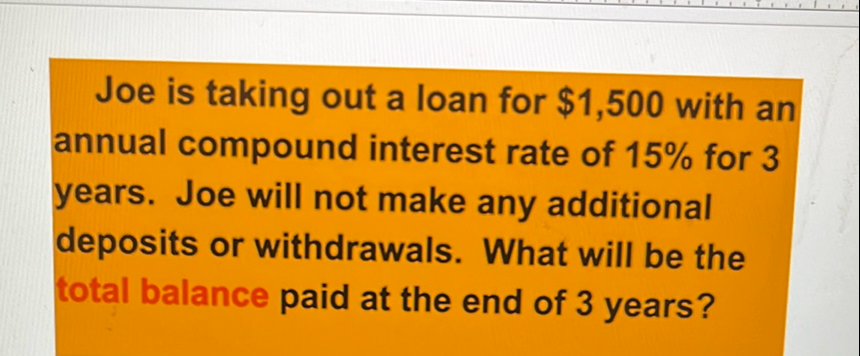

Q. Joe is taking out a loan for with an annual compound interest rate of for years. Joe will not make any additional deposits or withdrawals. What will be the total balance paid at the end of years?

- Identify Variables: Identify the variables for the compound interest formula.Principal amount = Annual interest rate = or (as a decimal)Number of years = Compound frequency = (since no specific compounding frequency is mentioned, we assume it is compounded annually)

- Use Formula: Use the compound interest formula to calculate the total balance at the end of years.The compound interest formula is , where is the amount of money accumulated after years, including interest.Substitute the given values into the formula:

- Calculate Total Balance: Calculate the total balance using the formula.

- Check Calculation: Check the calculation for any mathematical errors.Re-evaluate the exponent: (correct)Multiply by the principal amount: (correct)