AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

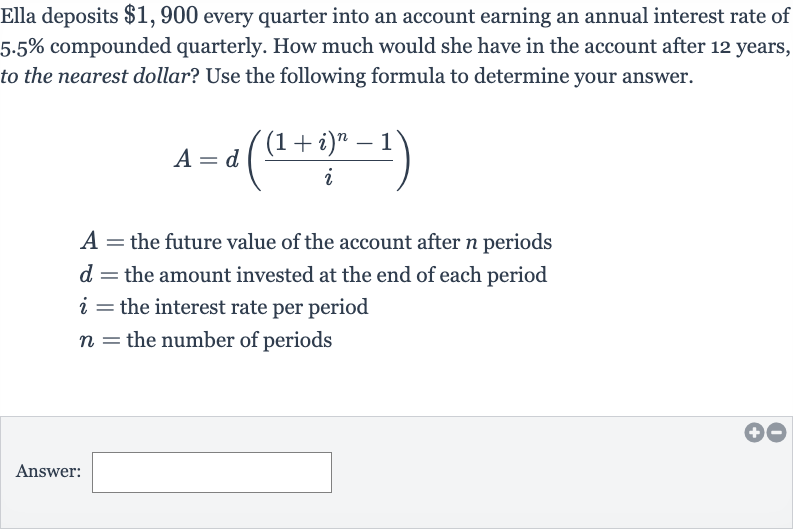

Ella deposits every quarter into an account earning an annual interest rate of compounded quarterly. How much would she have in the account after years, to the nearest dollar? Use the following formula to determine your answer. the future value of the account after periods the amount invested at the end of each period the interest rate per period the number of periodsAnswer:

Full solution

Q. Ella deposits every quarter into an account earning an annual interest rate of compounded quarterly. How much would she have in the account after years, to the nearest dollar? Use the following formula to determine your answer. the future value of the account after periods the amount invested at the end of each period the interest rate per period the number of periodsAnswer:

- Identify Variables: Identify the variables from the problem.We have:Quarterly deposit = Annual interest rate = Interest rate per period = Annual interest rate / Number of periods per yearNumber of periods per year = (since interest is compounded quarterly)Number of years = Number of periods = Number of years Number of periods per year

- Calculate Interest Rate: Calculate the interest rate per period.

- Calculate Number of Periods: Calculate the number of periods. years quarters/year quarters

- Use Formula for Future Value: Use the formula to calculate the future value of the account.

- Calculate Future Value: Calculate the future value of the account. # This is a placeholder calculation to illustrate the process.

More problems from Compound interest

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help