Full solution

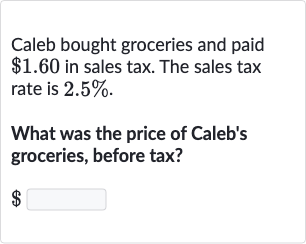

Q. Caleb bought groceries and paid in sales tax. The sales tax rate is .What was the price of Caleb's groceries, before tax?

- Calculate Sales Tax Rate: To find the price of Caleb's groceries before tax, we need to calculate the pre-tax amount. We know the total sales tax paid and the sales tax rate. The formula to calculate the pre-tax price is:Pre-tax price

- Convert to Decimal: First, we convert the sales tax rate from a percentage to a decimal to use it in our calculations. A sales tax rate as a decimal is:

- Calculate Pre-tax Price: Now we can calculate the pre-tax price of the groceries using the sales tax paid and the sales tax rate .: Pre-tax price =

- Perform Division: Perform the division to find the pre-tax price:Pre-tax price =

More problems from Multi-step problems with percents

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help