AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

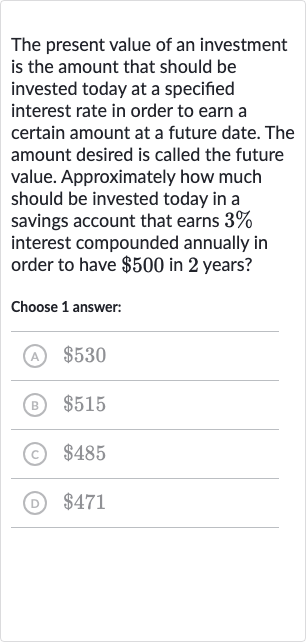

The present value of an investment is the amount that should be invested today at a specified interest rate in order to earn a certain amount at a future date. The amount desired is called the future value. Approximately how much should be invested today in a savings account that earns interest compounded annually in order to have in years?Choose answer:(A) (B) (C) (D)

Full solution

Q. The present value of an investment is the amount that should be invested today at a specified interest rate in order to earn a certain amount at a future date. The amount desired is called the future value. Approximately how much should be invested today in a savings account that earns interest compounded annually in order to have in years?Choose answer:(A) (B) (C) (D)

- Identify values: Identify the values of (future value), (interest rate), (number of times the interest is compounded per year), and (time in years).Future Value () = Interest Rate () = Number of times compounded annually () = Time () = years

- Convert interest rate: Convert the interest rate from a percentage to a decimal.

- Use present value formula: Use the formula for present value (PV), which is the inverse of the compound interest formula: .Substitute for FV, for r, for n, and for t.

- Calculate present value: Calculate the present value.PV = First, calculate the denominator: = = =

- Divide by denominator: Now, divide the future value by the calculated denominator to find the present value.

More problems from Compound interest: word problems

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help