Full solution

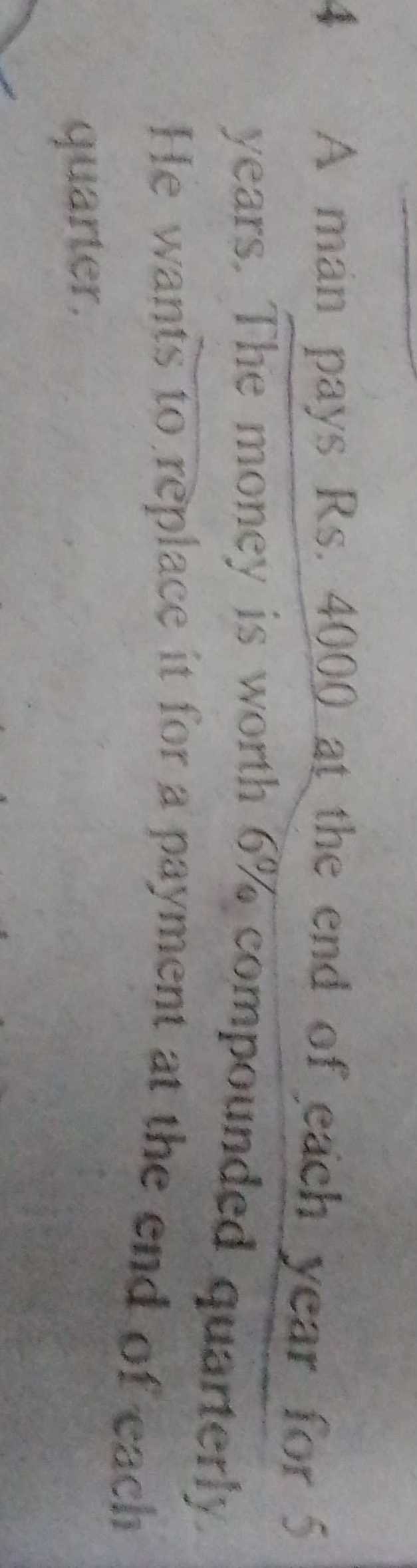

Q. A man pays Rs. at the end of each year for years. The money is worth compounded quarterly. He wants to replace it for a payment at the end of each quarter.

- Calculate interest rate per quarter: Calculate the interest rate per quarter.Interest rate per annum = Interest rate per quarter =

- Calculate future value of annuity due: Calculate the future value of an ordinary annuity due to the annual payments.Using the formula for the future value of an ordinary annuity: Where annual payment, quarterly interest rate, total number of quarters., , quarters